Recently, there have been several intentions to construct earth gas power plants announced in Slovakia. Among them are concrete intentions as well as preliminary information on their position and output. This development stands for new challenge for the country because their conduction will have to be included in the energy mix and several questions linked with them will have to be solved.

Current situation in electric energy production in Slovakia

The Slovak Republic committed itself within the EU accession talks to shut down two blocs of the nuclear power plant V1 in Jaslovské Bohunice by 2009. The first bloc was shut down on 31st December, 2006, and the second one will be shut down on 31st December, 2008. According to the latest information, however, the Slovak Republic consumed more energy than it generated as early as 2007 and this trend will continue in next years (1).

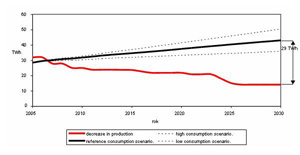

Nevertheless, the elimination of production capacities will go on. It’s reckoned that a capacity of 1370 MW will be put out of operation in the period between 2006 and 2010. According to Slovenská elektrizačná prenosová sústava (SEPS, a.s.) transmission network there will be an output cutback amounting to 3855 MW in Slovakia by 2030, i.e. 56 per cent less in comparison with the year 2006. This development will continue in the context of growing electric energy consumption and there will be annual output reduction of 1.6 per cent on average till 2030 as it is shown in picture No.1 (2).

In this situation, the Slovak Republic has several options how to act and which new sources it is to support. It’s obvious that the future development of electro energy isn’t feasible without the completion of two other blocs of the nuclear power plant in Mochovce which perform the function of main power electricity. The construction of a nuclear power plant, however, is a financially demanding and time-consuming process and therefore the attachment of new blocs isn’t to be expected prior to 2012 (3).

In this situation, the Slovak Republic has several options how to act and which new sources it is to support. It’s obvious that the future development of electro energy isn’t feasible without the completion of two other blocs of the nuclear power plant in Mochovce which perform the function of main power electricity. The construction of a nuclear power plant, however, is a financially demanding and time-consuming process and therefore the attachment of new blocs isn’t to be expected prior to 2012 (3).

It means that for the entire Slovak Republic it’s crucial to cover the period 2009 – 2012 in which it will lack the most capacity and its consumption will be increased concurrently. This is caused primarily by the rapid growth of Slovak Republic’s economy. This development is corrected by the increasing energy efficiency of economy, although this is still more demanding than EU-25 average (4).

In order to surmount the period 2009 – 2012, it’s possible to apply several scenarios. The import of electric energy from abroad seems to be the easiest way. Anyway, in a situation, in which production capacities are insufficient in the whole of Europe and the demand for electricity has been growing, high import dependence is dangerous for an economy. The reason is import dependency itself, which is sustainable and safe only to some extent, as well as the growing dependency of electricity price on foreign reference stock exchanges, particularly in Germany (5). This, however, is going on also nowadays, electricity is a commodity traded in throughout the EU. Therefore price interaction in individual countries occurs, but the states are capable of overcoming major fluctuations thanks to sufficient domestic production capacities. According to the Draft Energy Security Strategy, in the period between 2009 and 2012, 15 – 20 percent of overall demand for electric energy would be met through import, which is sustainable just temporarily.

The second option how to weather the period 2009 – 2012 is the building of new sources. Energy self-sufficiency is one of the signs of energy security. Here we come to the concept of energy mix which represents the composition of sources for electricity production within economy (6). Today in Slovakia, the most of electric energy is produced in nuclear power plants and their share in final consumption is one of the highest ones in Europe. The EU has committed itself to cut down on CO2 emissions the direct existent manifestation of which is trading in CO2 emissions (ETS – Emission Trading System). This factor wasn’t taken into consideration in terms of the construction of existent important sources in the territory of the Slovak Republic because it simply didn’t exist. Emission permits should be bought also by energy companies after 2013 (7).

When planning the construction of new sources, one has to take into account more factors than in the past. Though economic factors are still in the first place, environmental ones along with the consequences emerging from the ongoing implementation of renewable sources are considered to a still larger degree.

At this point we won’t deal with justifying nuclear power plant construction because the author of analysis regards their advantages as a fact. We will focus on steam-gas power plants which use earth gas and have several positive but also negative features.

Steam-gas power plants – concise technical description

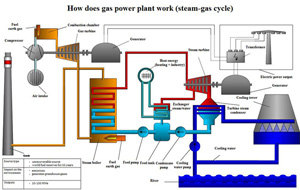

Steam-gas (steam-gas cycle – SGC) is a power plant working in thermal cycle (like a nuclear power plant, but in contrast to a water or wind power plant). The main part of SGC is a gas turbine in which earth gas is burnt and hot waste gasses (approximately 600 ºC) warm up the steam which propels another turbine, a steam one. Such a complex reaches an efficiency of around 50 – 60 per cent (8).

Steam-gas power plants at the same time can, but needn’t, use the heat which they produce. If it comes to its direct utilisation, they stand for a combined production of electricity and heat (CHP – combined heat and power). Here the efficiency is increased up to 85 per cent (9). Apart from earth gas sources, also coal and nuclear power plants as well as biomass sources belong to CHP.

As mentioned above, the economy of steam-gas cycles is yet to be improved provided that all low-potential heat, which originates and is usually discharged into air, is used. Preconditions for this are in towns and industrial parks. Towns, however, aren’t mostly able to absorb the whole of produced heat, but, for instance, the whole of heat and a big steam-gas plant could be placed in Košice. In smaller towns like Nitra or Trnava, heat from steam-gas plants with an output of around 50 MW could be positioned. The proximity of consuming towns is an important factor because long-distance transport via heat pipelines steps up losses and demands for pipeline insulation shrinking thus return on financial means. The Bratislava Steam-gas Cycle (the present name of the company is PPC Energy Group, a.s.) functions on similar basis. It concluded a heat supply contract with Bratislavská teplárenská heat supplier, an agreement concerning electric power consumption with Slovenské elektrárne and a system service supply contract with transmission network operator (10). Combined electricity and heat production (CHP) is one of the most effective possibilities of utilising fossil fuels at present. A well-arranged graph showing the functioning is in the picture No.2.

In the past, steam-gas power plants weren’t used at basic load, i.e. they weren’t in operation during the whole year. They were used primarily during peak load where spasmodic additional network outputs were necessary (maximum outputs occur mornings and evenings). Selling peak electricity, they ensured economic and effective functioning. To this end, however, not the complicated combined cycles using also generated heat, but units with simpler circle were utilised. In Slovak conditions, if we compare the annual operation hours of the nuclear power plants in Jaslovské Bohunice and Mochove, as sources in basic load, with the operation time of steam-gas cycle, we get the difference amounting to approximately 2000 hours. It means that steam-gas cycle in Slovakia is used also for the production of basic power energy, it functions in semi-peak power (11).

In the past, steam-gas power plants weren’t used at basic load, i.e. they weren’t in operation during the whole year. They were used primarily during peak load where spasmodic additional network outputs were necessary (maximum outputs occur mornings and evenings). Selling peak electricity, they ensured economic and effective functioning. To this end, however, not the complicated combined cycles using also generated heat, but units with simpler circle were utilised. In Slovak conditions, if we compare the annual operation hours of the nuclear power plants in Jaslovské Bohunice and Mochove, as sources in basic load, with the operation time of steam-gas cycle, we get the difference amounting to approximately 2000 hours. It means that steam-gas cycle in Slovakia is used also for the production of basic power energy, it functions in semi-peak power (11).

It’s clear that this trend has been changing because of the lack of production capacities in Europe nowadays. Nonetheless, it’s not possible to put steam-gas cycles into the position of an alternative, for example, to nuclear power plants.

The positive and negative features of steam-gas cycles (SGC)

It is the flexibility of output regulation (the primary and secondary regulation of frequency and output) (12), relatively short construction time and low CO2 emission which are the three substantial and positive factors mentioned as regards the planned construction of gas power plants. Steam-gas cycle provides a wide range of output regulation from the 60 per cent to 100 per cent of rated output throughout the year. Another advantage, which is used also by the electricity transmission network operator (In Slovakia it is Slovenská elektrizačná pernosová sústava – SEPS, a.s.) is the possibility of a rapid power change in time.

As far as CO2 emissions are concerned, in January the European Union (EU) introduced a climatic and energy package which contains aside from other things also draft revision of the directive 2003/87/EC on trading in permits for greenhouse gas emissions and a proposal to cut back on CO2 emissions by 20 per cent till 2020 (13). From 2013, 100 per cent of permits as well as their allocation will have a strong influence also on the development of electric energy prices. We may say that if the system is strict, energy companies will have to carry out costly measures to save permits, which may result in further growth of energy prices. If that’s the case, old power plants, which have been a cheap energy power source to date, could be shut down. Anyway, this development forces companies to orientate themselves on new production capacities like gas power plants.

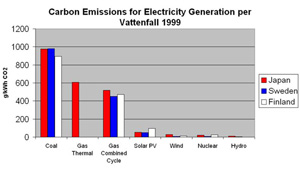

Comparing power plants generating electricity from various sources, coal power plants are the worst as for emissions. These types of power plants discharge averagely 850 kg CO2/MWh. Oil-burning power plants discharge 590 kg CO2/MWh and gas ones 370 kg CO2/MWh (14). Data concerning individual energy sources, however, aren’t uniform and it’s conceivable to find diverse figures in connection with CO2 discharge into air. I show a study conducted by the company Vattenfall from 1999 and its results in graph No.1 as an example.

The construction of gas power plants lasts just two years on average, which is approximately three times less in comparison with conventional sources.Since there’s the liberalisation of energy sector under way in the EU and new investors interested in building new energy sources have been entering individual countries, it is steam-gas cycles which stand for an interesting investment for them. Independent producers extend thus the portfolio of electric power producers and liberalisation itself is supported. Also energy security, predominantly the security of electric energy supplies, which is backed by distributed electric energy production (distributed energy sources), has been reinforced. It is the combined production of electricity and heat (cogeneration), in this case its subgroup steam-gas cycles, that represents the tangible manifestation of distributed sources. Nonetheless, one has to point out that in the case of small cogeneration units, heat generation stands in the foreground and electric energy is secondary product. That’s why stable heat consumption must be agreed on due to their economical operation.

The construction of gas power plants lasts just two years on average, which is approximately three times less in comparison with conventional sources.Since there’s the liberalisation of energy sector under way in the EU and new investors interested in building new energy sources have been entering individual countries, it is steam-gas cycles which stand for an interesting investment for them. Independent producers extend thus the portfolio of electric power producers and liberalisation itself is supported. Also energy security, predominantly the security of electric energy supplies, which is backed by distributed electric energy production (distributed energy sources), has been reinforced. It is the combined production of electricity and heat (cogeneration), in this case its subgroup steam-gas cycles, that represents the tangible manifestation of distributed sources. Nonetheless, one has to point out that in the case of small cogeneration units, heat generation stands in the foreground and electric energy is secondary product. That’s why stable heat consumption must be agreed on due to their economical operation.

Among other SGC are their own fuel consumption and low operating costs (fuel costs aren’t considered) as well as small room necessary for building and a small number of service staff, in comparison with other power plant types (15).

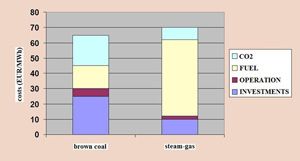

Among negative factors are high commodity expenditures, namely earth gas, the price of which accounts averagely for 65 – 70 per cent of overall operating costs. It is expenditures on commodity purchase and overall operation which are higher not only when compared to nuclear power plants, but also brown coal ones (if they’re built near mines). However, coal power plants lose partly the benefit of an economically advantageous source because of trading in emissions, which are high in their case. Notwithstanding this, these types of power plants are one of the economically most efficient ones as they’re developed in regions and countries which have own coal deposits. In picture No. 3 we can see the comparison of expenditures on new sources, namely brown coal source and steam-gas one (excluding the liquidation of expenditures on waste disposal).

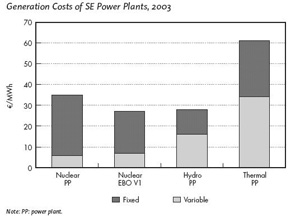

In picture No. 3 we may see the high share of fuel in the case of steam-gas cycles, but investments, CO2 permissions and operation are at lower level. In picture No. 4, which is, however, based on data from 2003, is the comparison of 1 MWh generation costs of the company Slovenské elektrárne, a.s. in various types of power plants. Costs are divided solely into fix and variable ones. Fix costs represent construction investment expenditures (which are high in connection with nuclear power plants in particular), the rest stands for variable ones. Thanks to the comparison of both pictures, we have the basic notion of relations between defined costs among individual electric energy sources. A more thorough comparison isn’t conceivable since there is a several year difference between data sources in both charts.

In picture No. 3 we may see the high share of fuel in the case of steam-gas cycles, but investments, CO2 permissions and operation are at lower level. In picture No. 4, which is, however, based on data from 2003, is the comparison of 1 MWh generation costs of the company Slovenské elektrárne, a.s. in various types of power plants. Costs are divided solely into fix and variable ones. Fix costs represent construction investment expenditures (which are high in connection with nuclear power plants in particular), the rest stands for variable ones. Thanks to the comparison of both pictures, we have the basic notion of relations between defined costs among individual electric energy sources. A more thorough comparison isn’t conceivable since there is a several year difference between data sources in both charts.

It is global earth gas consumption (the EU itself as well) which is to grow the most (Although forecasts concerning rapid growth have been regularly modified and aren’t thus much ambitious like few years ago) in next years (prospects till 2030 – 2050). As the EU hasn’t enough own sources and there are only few regions in the world which are important producers, earth gas question enters the political level. In the EU, there are concerns over too strong dependence on a single raw material source, which is in the case of the EU primarily the rising Russian Federation.

It is global earth gas consumption (the EU itself as well) which is to grow the most (Although forecasts concerning rapid growth have been regularly modified and aren’t thus much ambitious like few years ago) in next years (prospects till 2030 – 2050). As the EU hasn’t enough own sources and there are only few regions in the world which are important producers, earth gas question enters the political level. In the EU, there are concerns over too strong dependence on a single raw material source, which is in the case of the EU primarily the rising Russian Federation.

According to International Energy Agency (IEA) global demand for earth gas will be growing by 2.6 per cent in the period 2005 – 2015. Earth gas power plants will be responsible for half of overall consumption growth. Consumption in OECD countries will grow from 1465 billion m³ in 2005 to 1726 billion m³ (average expected annual growth is 1.7 per cent) (16).

The factors mentioned above affect positively as well as negatively companies’ decisions to invest in developing power plants on the basis of earth gas not only in Slovakia.

Steam-gas power plants in Slovakia – existent and planned ones

Aside from several small regional steam-gas cycles, there is just a single one functioning in Slovakia, namely the Bratislava Steam-gas Cycle. Its output is 218 MW, it generated 1001 GWh of electric power and 2200 Tj of heat in 2006. Simultaneously, it consumed 247 million m³ of earth gas 2006. The steam-gas cycle in Bratislava constitutes about 4 per cent of the total electric energy capacity. This power plant is an example of combined electricity and heat production with high efficiency. The company Penta, which became one of the owners of the steam-gas cycle in 2007, at the same time announced its further development. In the company site, it wants to build a new 60 MW output source similar to the existing one (17). Common gas consumption could rise over 300 million m³ in this way.

In October 2007, the second, smaller, steam-gas power plant in Slovakia was put into operation in Levice. Its operator is the company Slovintegra and the facility supplies electric energy as well as heat. The output capacity amounts to 80 MW and generated energy is supplied into the distribution network of Západoslovenská energetika (18). According to original intentions the power plant was meant to be attached directly to a transit gas pipeline avoiding thus gas distribution charges for SPP. It was also given the authorisation to construct own distribution network by the Economy Ministry of the Slovak Republic. The company Eustream set the sale of the connection facility for earth gas transit network as a condition for the attachment of distribution network. Thus it abused its dominant position according to the Antimonopoly Office (19).

Among announced projects, which are very likely to be conducted, is the steam-gas power plant in the village of Malženice in western Slovakia. The supposed output should amount to 430 MW and operation launch is due in 2010. The project is conducted by the company E.ON, which has a 40 per cent share in Západoslovenská energetika.

In accordance with official data production output is estimated at 2 TWh of electric energy, efficiency will approach 60 per cent. Earth gas, the consumption of which is reckoned to be more than 500 million m³, will stand for the energy source. The steam-gas plant won’t keep on using and selling the generated heat, but it will concentrate on semi-peak electricity production only (20).

From the point of view of the network, however, the power plant’s position is unfavourable. Deficiency in production sources is perceptible mainly in eastern Slovakia. In western Slovakia, there’s an excess of energy due to nuclear power plant concentration and the waterwork Gabčíkovo. There would be a reverse run in the case of steam-gas cycle. Earth gas would flow due west and generated electric energy due east. The economic efficiency of the investment is questionable too since further utilisation of generated heat isn’t considered. Certain possibility of compensation might be the provision of supportive services as well as the sale of expensive peak electricity.

In July 2008, the company Stredoslovenská energetika, a.s. announced the construction of a simple gas cycle in central Slovakia nearby Lučenec. The estimated time of building completion is the end of 2009. The output capacity will reach two 2 x 50 MW and it’s supposed to concentrate mainly on the supply of peak energy into the network of Slovenská elektrizačná prenosová sústava, a.s. That’s the reason for choosing a simple cycle the economic costs of which can be met by high price for peak energy. The construction will be situated in the former site of an earth gas compressor station, which will facilitate attachment to its source because this is positioned on the transit gas pipeline. The efficiency of the facility is reckoned on 41 per cent. As the power plant will manage primarily peak loads, earth gas consumption isn’t fixed firmly. This will reach maximally 91 million m³ in the case of full-year top-level operation. However, it will depend on the demand for such electric energy (21).

The collaboration between the Czech company ČEZ and the Hungarian oil and gas company MOL has been made public as well. After ČEZ had bought a part of shares, both companies agreed on joint steps in terms of electro energy. The result should be two steam-gas power plants, the first one in Slovnaft site and the other one in Hungary. By joining the forces of both companies, there will by a synergy effect since ČEZ is experienced in electro energy and MOL is a gas company with access to sources. The source, which is supposed to be built on the premises of the company Slovnaft, will have capacity of 800 MW (22). It’s assumed that the power plant with such an output will supply not only stable energy to Slovnaft, but also power energy into the network. On the grounds of the officially announced output of the power plant, earth gas consumption is estimated at around 1 billion m³ per annum.

Among the latest publicly announced projects is the steam-gas power plant on the premises of the power plant Vojany in eastern Slovakia. The power capacity should amount to 400 MW and Slovenské elektrárne, a.s. will be its constructor. This power plant is important predominantly owing to lack of capacities in eastern Slovakia (23). The last of the big announced projects is the steam-gas cycle in Žilina with a 500 MW output (24).

Also several smaller steam-gas power plant projects were announced in Slovakia. All of them will contribute to the growth of earth gas consumption in Slovakia during next years. After the outbreak of financial crisis, it’s questionable which of the announced projects will get the ultimate investment decision. According to available information, the most real is the completion of steam-gas plants in Malženice and near Lučenec. Anyway, steam-gas power plants represent a course which is capable of coping with deficiency in production capacities as well as electric energy consumption growth in the long term not just in Slovakia. That’s why projects, the conduction of which can presently be prevented by the ongoing crisis as well as increase in credit price emerging from it, may be realised later.

The development of such a type of power plants isn’t typical just of Slovakia. The International Energy Agency (IEA) wrote in its study Natural Gas Market Review 2008 that steam-gas power plants alongside wind energy are the only two sources whose production capacity has been constantly stepped up since 2000. In the EU, the share of these sources should be increased from 16 per cent in 2000 to 25 per cent in 2010. For several countries, their development is one of the cheapest possibilities how to reduce CO2 emissions in the short term (25).

The development of earth gas consumption in Slovakia

In 2006, earth gas sale in the Slovak Republic accounted for 6.283 billion m³. The consumption of major and minor consumers rose, whereas the consumption of households sunk. The reason was saving measures, but particularly gas price growth and thus preference to other fuels like wood and coal. According to the Draft Energy Security Strategy gas consumption should stay on current level till 2013 or rise to 7 billion m³ maximum. The mentioned strategy counts on the necessity to construct two steam-gas cycles, one in eastern and the other in central or western Slovakia. Both should have capacity of around 200 MW and the reason is the covering of the demand for electric energy as well as network regulation (26).

This means that steam-gas sources, which investors plan to build, exceed plans defined in the document. Moreover, we may expect further growth of earth gas consumption. Although households consume less earth gas, entrepreneurial subjects consume more to compensate.

If just the projects in Malženice and in Lučenec were realised, earth consumption would grow by 600 million m³ after 2010. These projects seem to be the most concrete ones and the probability of their construction is high.

The steam-gas power plant project in Slovnaft company site can be considered relatively certain too. On the one hand it would be able to cover the demanding energy refinement as well as to supply industrial heat. On the other hand it would enable the entry of investors into electric power market in the region defined by ČEZ as its priority. Project conduction will cause consumption increase by approximately 1 billion m³ provided that it is realised with the announced 800 MW output. However, the completion term remains a question.

Among less certain are big projects in Vojany and Žilina. Both have similar outputs, namely 400 MW and 500 MW. Their conduction would step up the consumption by further 1 billion m³. It means that we may count on increase by 600 million m³ in medium term till 2010 and further 2 billion m³ on the condition that current trends in the consumption of entrepreneurial subjects and households are maintained (27).

Steam-gas power plants are dependent on the development of earth gas prices on global markets. Most of contracts are tied to oil and its derivates which undergo diverse fluctuations. This development will thus affect also gas prices several months later and that’s why it must be taken into consideration during the construction. One has to point out that SGC construction is cheaper and faster than the building of other conventional sources and gives them partial advantage in this way. Once a power plant is built, it’s hard to imagine that it wouldn’t generate profit despite high earth gas price.

It is the orientation of steam-gas cycles, possible prediction of their consumption and relative output constancy (if they don’t cover peak supplies only) which provide room for new types of flexible tailor-made earth gas supplies as well as the entry of alternative suppliers.

Possible earth gas sources for SCG

The development of earth gas market liberalization and the construction of SCG sources, which doesn’t belong to the portfolio of dominant energy producers, raise questions of earth gas sources for power plants. We may actually divide them into two categories, namely a contractual agreement with existent monopoly (dominant) gas supplier in the given region or an agreement with alternative supplier. It is the second option which is presently an interesting and conceivable trend that has been upheld also by the formal opening of market in the Slovak Republic since 2007.

Two possibilities may serve as gas source from alternative suppliers. (We don’t consider domestic extraction which is negligible in Slovakia.) The first one is swap operations (gas exchange) between alternative supplier and dominant company. Room for commodity exchange will exist because strong supranational companies with an uncomplicated (and mainly existent) access to gas will be new possible suppliers. In practice it would mean the exchange of earth gas supplies for a steam-gas power plant for another similar contract in another territory. This could be either gas supply contract for a concrete consumer or a contract concerning earth gas itself (without further definition).

The second possibility of alternative suppliers’ earth gas is gas trading places, i.e. hubs. In the case of Slovakia, the nearest commercial hub is in Austrian Baumgarten. More than fifty active participants are registered on its commercial platform. Also Slovak companies are among them. Hubs provide more transparent price creation than long-term contracts. Commercial hubs also provide greater flexibility which results in the possibility of selecting services that gas consumer orders from the trader (pick-from-the-menu principle, but responsibility for bad service choice too). Supplied earth gas isn’t often restricted by destination clause that doesn’t prevent further commodity sale. Theoretically, in the case when electric energy generation isn’t profitable for a power plant (earth gas prices are extremely high plus electricity production costs – generated electricity price cannot compete), the company could decide to sell earth gas further instead of burning it in turbine.

It remains a question to what extent the prices on hubs are different in long-term contracts and to the detriment of which type. Trading on hubs is accompanied also by problems with gas transport and storage and therefore the trader must have contracts with the operator of transmission and distribution network as well as with the operator of earth gas storage tanks.

This type of earth gas supplies for power plants in Slovakia is hitherto on a theoretical level, but it cannot be ignored. Of course, the decisive factor is the price of the commodity supplied when entering a power plant.

Conclusion

Obviously the development of steam-gas power plants cannot be unrestrained and has to correspond to network operator’s development plans as well as state strategy. The main risk is high correlation between these power plants and earth gas prices which aren’t expected to decrease significantly. The advantage is output regulation and thus also the possibility of developing and attaching (unstable) renewable energy sources to the network. Simultaneously, the development of gas power plants is a challenge for new suppliers entering open market for earth gas supplies. The objective is that they establish themselves on the market and choose suitable customers.

Notes:

(1) Report on the result of the monitoring of electricity supply security (July 2008), p. 3,

http://www.economy.gov.sk/files/Energetika/SpravyBezpecost/sprava_elektrina2008.doc

(2) Draft Energy Security Strategy, p. 87-88,

http://www.economy.gov.sk/files/Energetika/SEB/SEB.doc

(3) Začala dostavba Mochoviec, 5th November, 2008, EurActiv,

www.euractiv.sk/energetika/clanok/zacala-dostavba-mochoviec

(4) Na Slovensku výrazne poklesla energetická náročnosť,

http://ekonomika.sme.sk/c/4135446/na-slovensku-vyrazne-poklesla-energeticka-narocnost.html, 21st October, 2008

(5) EEX – European Energy Exchange, www.eex.de

(6) See for example

http://www.hi-energy.org.uk/glossary.html

(7) Barrosova vízia nízkoemisnej ekonomiky, EurActiv,

http://www.euractiv.sk/energetika/clanok/barrosova-vizia-nizkoemisnej-ekonomiky, 23rd January, 2008

(8) Comparison of the efficiency of several types of power plants, for instance –

http://www.umweltbundesamt.at/fileadmin/site/umweltthemen/industrie/IPPC_Konferenz/donnerstag_kraftwerke/6-_Van_Aart.ppt

(9) Calculation of the efficiency of combined electricity and heat , for example –

http://www.epa.gov/CHP/basic/methods.html

(10) Annual Report 2006, company Paroplynový cyklus, a.s. Bratislava, page 7,

http://www.paroplyn.sk/chillout5_items/4/4/44_cb0908.pdf

(11) According to the Annual Report 2006 of the company Paroplynový cyklus, a.s. Bratislava, gas turbine worked in 2006 5958 hours and steam one 5791 hours (source – http://www.paroplyn.sk/chillout5_items/4/4/44_cb0908.pdf, page 16). In 2004, the operation time of nuclear power plants in Mochovce and Jaslovské Bohunice was between 7000 and 8000 hours (www.seas.sk). Total annual hour capacity amounts to 8760 hours.

(12) For the explanation of the terms primary and secondary regulation of transmision network see –

http://www.sepsas.sk/seps/OK_DefinicieNazvy_07.asp?Kod=150&Nadrad=82

(13) For climatic-energy package see for instance – Pitorák, M.: Klimaticko-energetický balíček, Pro-Energy, http://www.pro-energy.cz/clanky6/4.pdf, Návrh postupu prípravy pozície SR na rokovania o integrovanom klimaticko-energetickom balíčku EK, http://www.rokovania.sk/appl/material.nsf/0/2A2E63F50026529CC1257405004BBFBD/$FILE/vlastnymat.rtf

(14) Jha, A., Macalister, T.: CO2 plan threatens new coal power plant, The Guardian, 13th June, 2008,

http://www.guardian.co.uk/environment/2008/jun/13/carboncapturestorage.fossilfuels1

(15) Paroplynové elektrárne – súčasnosť a výhľad do budúcnosti, magazine Strojárstvo,

http://strojarstvo.sk/inc/index.php?ln=SK&tl=3&tpl=archiv.php&ids=2&cislo=11/2000&idclan=134

(16) Publication „Natural Gas Market Review 2008″ available on

http://www.iea.org/w/bookshop/add.aspx?id=341

(17) Marčan, P.: Penta ovládla paroplyn, eTrend, 28th November, 2007,

http://www.etrend.sk/firmy-a-trhy/firmy/penta-ovladla-paroplyn/119831.html

(18) V Leviciach spustili paroplynovú elektráreň, SME, 6th October, 2007,

http://www.sme.sk/c/3522326/V-Leviciach-spustili-paroplynovu-elektraren.html

(19) The Board of the Antimonopoly Bureau of the Slovak Republic confirmed that it fined the company Eustream, a.s. 98.9 million Sk for abusing its dominant position, 6th October, 2008, http://www.antimon.gov.sk/article.aspx?c=12&a=3172

(20) Facts about the planned steam-gas power plant in Malženice – http://www.eon-elektrarne.com/pages/ekw_sk/Elektrre_Malenice/Fakty_a_%26%23269sla/index.htm

(21) Basic information on intention, EIA, eia.enviroportal.sk/dokument.php?id=44948, page 3

V Slovnafte vyrastie veľký paroplyn, eTrend, 21st December, 2007, http://www.etrend.sk/firmy-a-trhy/firmy/v-slovnafte-vyrastie-velky-paroplyn/122247.html

(23) Slovenské elektrárne chcú postaviť vo Vojanoch paroplyn, Hospodárske noviny, 9th October, 2008, http://hnonline.sk/c1-28900950-slovenske-elektrarne-chcu-postavit-vo-vojanoch-paroplyn

(24) Intention submission announcement,

http://eia.enviroportal.sk/detail/paroplynovy-cyklus-zilina; for instance – http://www.government.gov.sk/8846/

(25) Publication „Natural Gas Market Review 2008″ available on

http://www.iea.org/w/bookshop/add.aspx?id=341

(26) According to the Draft Energy Security Strategy of the Slovak Republic,

http://www.economy.gov.sk/files/Energetika/SEB/SEB.doc

(27) Author’s own calculations